Sometimes the biggest problem with weeknight dinners is figuring what to make when you get home from work. Generally you’re somewhat hungry and exhausted from making too many decisions at work and an additional decision, even of just what to have for dinner, puts you over the edge. Even adults can have low blood sugar melt-downs.

Now, to fix this problem, you could do what one set of our friends does and have the same thing to eat every week. Monday is chili night. Tuesday is Spaghetti night, and so on. (Wasn’t there a commercial about that?) Problem solved.

We need more adventure than that, however. Otherwise I might have to take up skydiving, and nobody wants that. So that means new and different meals that can be made quickly on weeknights with minimal advance planning. Pantry meals. Or meals with ingredients that will last between weekly grocery store trips.

There are online services out there that will give you a weekly menu plan complete with grocery list, taking the thinking out of the process. We tried a couple of these at various points, but they always seem to call for exotic ingredients that we can’t get given our lack of Whole Foods, take much longer than the 20 min we have for making dinner (if the cookbook is called, “20 min meals” it is LYING), and end up leaving mostly unused jars of ingredients in the fridge to rot. Alternatively, they focus on pouring can of Campbell’s X over Pillsbury Y, which is not only unhealthy but doesn’t taste great if you’re unused to so much processed stuff. So, a great idea in theory, but in practice they seem to be unworkable.

Fortunately it’s pretty easy to cobble together your own menu plan with minimal mental effort using one or two cookbooks by the mother-son team of Nancy and Kevin Mills. If there are 1-3 people in your family, use Help! My apartment has a kitchen! If there are 3-5 people, use Faster! I’m starving! Obviously you can use your own cookbooks, but we like these because they are actually accurate in terms of preparation time, they use simple healthy and inexpensive ingredients that work well with a pantry, they have a nice variety of cuisines, and the meals are darn tasty. For non-meat eaters, Kevin Mills married a vegetarian before writing Faster!, so that book has more suggestions for making the meals veggie-friendly.

Open up your book of choice. Go to the first section (possibly salads, maybe appetizers), pick the first meal from that section (or the first meal that sounds good). Write it down on one sheet of paper (or used envelope) and put the ingredients that you do not have on your grocery list. Then move to the next section (chicken, for example), and pick the first meal from that section, adding its ingredients to the grocery list. Continue until you have 5-7 meals listed on the paper. Then go grocery shopping.

When you get home from work on Monday, instead of wondering what to have for dinner, just pick the first meal off the list and ~20 min later it should be ready to eat. Get the partner and/or kids involved too, if applicable.

What if you don’t feel like that day’s scheduled meal? That shouldn’t be a problem, just pick a meal further down the list– you should have all the ingredients from all meals on hand. We usually just have a list of meals, generally one or two more than we’ll be making before we next get to the grocery store. The default no-think option is the top one, but if that doesn’t sound good, we move to the next. Also we will often have one night that’s just leftovers (if not all of the leftovers have been eaten as lunches), or people can have leftovers instead of the planned meal.

The idea is that this kind of planning is more flexible than a strict menu plan and also takes less thinking than other forms of deciding what to have for dinner. There’s a default option for each day each week that is a pretty good option.

Is figuring out what to make for dinner stressful for you? Have you found ways to cut down on the mental load?

We’re struggling with this right now with DH’s impending job leaving, albeit from the other direction. As we’ve been discussing (and as we discussed last week), we have the money right now but in a few months we’ll lose 40% of our income. How much should we cut now? Should we stop eating out once or twice a week? Should we stop buying so much fancy cheese? We’re already spending at comfortable levels, but we may have to cut next year. So do we cut now? Do we start budgeting now? When we have a relatively high net worth, do we really need to cut at all? But our net worth isn’t high enough to generate enough income to finance our spending without drawing down our savings or at least not adding to them (we didn’t hit the financial independence cross-over point before DH quit his job). That line is hard. It is much easier to have more money than you know what to do with!

I left that comment on Rb40’s blog, and he suggested that we start living at 60% income now. But really we have been doing that. We spend XK/year. My take-home pay (not including summer money) will be XK/year. The difference is that we will no longer be putting away DH’s salary in mortgage pre-payments, extra retirement saving, and so on. (In previous years we banked more than DH’s salary! But kids can get expensive, especially when you choose private school and daycare.)

The problem is that when you spend XK/year and you make exactly XK/year, you’re living on the edge. Even when that XK/year is actual money spent including emergencies and not some dream budget, there’s still the worry that some month you’re going to get hit with too big an emergency and you’re not going to make it. It’s really easy to bank all your extra money when you have almost double what you need coming in every month. Even if you make a little mistake this month, you’ll just redirect some of next month’s money before the credit card bill comes due.

It’s not so easy when your income matches your expenditures almost exactly. I know, the standard response is to bulk up the emergency fund. A large emergency fund is something you can draw on in an emergency

And that leads to the push-pull part. On the one hand, we can bulk up the emergency fund now without much difficulty (and we are doing that). On the other hand we could cut spending so our outgo is not equivalent to our in-flow, and in theory we’d get used to that new level of spending.

Normally you need to cut spending to less than your take-home pay in order to bulk up the emergency fund, so you get into that spending-less habit before you have the emergency fund set up.

But our emergency fund is already set-up with our current levels of spending. We could make it bigger, but that wouldn’t really cut into our spending, just our savings. And it seems silly to have a huge cash emergency fund when that money could be going towards the mortgage or tax-advantaged savings instead.

So I dunno, we’re just going to keep going back and forth on this. Emotionally I’m probably going to end up cutting spending because I hate not having that monthly (flow) cushion no matter how much we have in an (stock) emergency fund. I just can’t handle it.

How about finishing with a challenge update:

So the minute I decide to limit spending, I feel like I need to spend. Probably because I’m thinking about spending, which is something I’m normally too busy to do. And then I can’t spend. I hate that. (Related: cash flows through me like water, but I rarely use my credit card.)

Our entertainment budget is on track with its automated billing from Netflix.

Went to target once to get replacement white flappy things for my breast pump, and that is all we got. Went a second time to get diapers (the mother’s helpers don’t do the EC or cloth) and nuts. Amazingly did not walk out with anything else.

We went a bit crazy with groceries. The weekend before last we had a dinner party. Then we ran out of yogurt and some other things in the middle of the week so DH decided to do a midweek trip before childcare came in the morning. We took advantage of some good sales to buy a few things in bulk. This weekend’s grocery shopping hasn’t posted yet, but we’re well over $300 at this point.

We have not eaten out once. Why not?

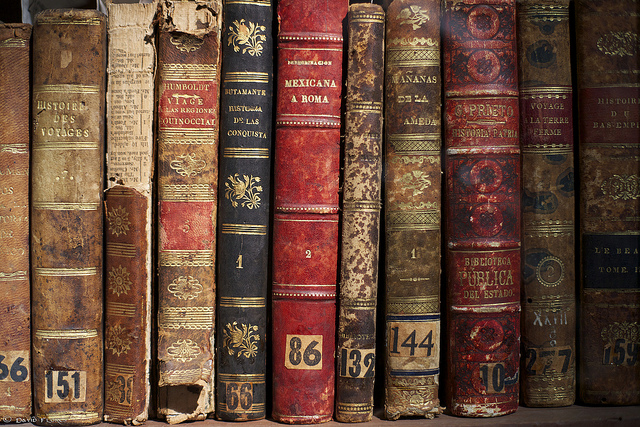

Because, to quote Erasmus… “When I have a little money, I buy books; and if I have any left, I buy food and clothes.” I ended up on my amazon wishlist and saw that a geometry textbook that I want to buy before DC1 is in middle school (many years from now) had dropped in price from $111 to $31. So I bought it. Couldn’t help it. I told myself, “That’s one meal out for the family. We won’t eat out this weekend.” So we didn’t. Then DC1 brought home a Scholastic order and we came up with $54 of books that we wanted to buy. So we did. And I thought to myself, “That’s an expensive lunch or a dinner out for us. We will not eat out this weekend.” And we didn’t. But really, lentils are quite tasty if you add enough bacon!

And $20 for a school fundraiser.

So, grumpy nation, if you had to choose among spending less so that your take-home income was more than your outflow, staying in a job you didn’t like, or spending exactly what you earn (not including mandatory retirement saving), what would you pick? What would help you make a decision?